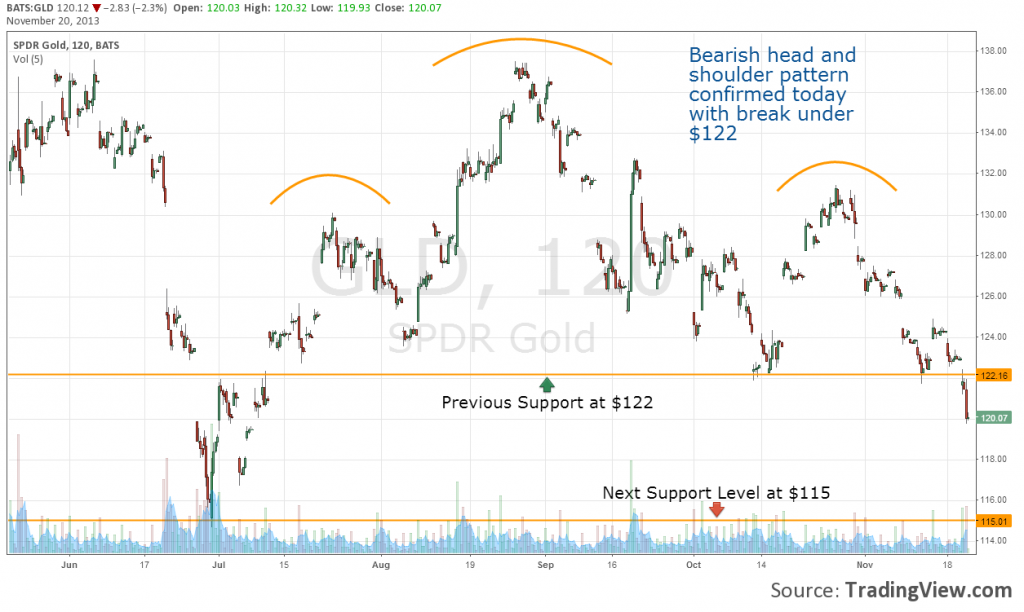

SPDR Gold Shares (GLD) Selling Off, Heading Lower

Head and Shoulders pattern suggests SPDR Gold Shares (GLD) is a sell

A very bearish head and shoulders pattern has formed in SPDR Gold Shares (GLD) chart the past 5 months. Support at $122 has been broken and GLD shares currently sit at $120. Looking at their chart, their next level of support appears to be at $115 in the short-term. We heard from the Fed Minutes today that tapering could be on table within the next few meetings. A strong jobs report for November would increase the likelihood that the central bank will start scaling back their stimulus program as other economic data has been looking better as of late. These measures are inevitable despite Bernanke and Yellen’s comments suggesting their willingness to keep the current program in place and have the potential to send GLD significantly lower.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article.

Pingback: Even John Paulson is Turning on Gold (GLD) » 5th Street Research