Icahn Sees Apple (AAPL) Shares Worth $1250 In 3 Years

Icahn Reiterates Call For Immediate $150 Billion Buyback From Apple (AAPL)

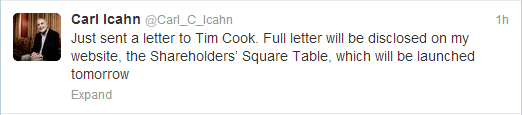

As promised yesterday, Carl Icahn launched Shareholders’ Square Table with a mission statement reading…

The Shareholders’ Square Table (SST) is a platform from which we can unite and fight for our rights as shareholders and steer towards the goal of real corporate democracy.

As a member of SST, you’ll receive emails with timely information on the movement, and have full access to our website containing:

- In depth reports about activism and various companies we are involved in

- Insights on business

- Commentary and criticism of certain actions by boards and CEOs

- ‘No-brainers’ and ‘Absurdities’

Most importantly, our periodic posts will discuss what can be done to change our current, dysfunctional system of corporate governance.

While there are many good CEOs and boards there are far too many ineffectual ones that are strangling shareholders and the economy.

In addition to posts discussing poison pills and executive compensation, Icahn posted his full letter to Tim Cook, CEO of Apple (AAPL). The overall tone was very supportive of Apple’s current business operations, management team, and plans for the future. He discloses that he has increased his stake in AAPL to 4.7 million shares, or about $2.5 billion at current levels. His sole criticism of Apple concerns the speed and size of their current buyback plan, given the availability of cheap money to finance a more sizable and swifter plan than is currently in place. He calls for an immediate tender offer for $150 billion worth of stock. Icahn makes it clear that he believes AAPL shares are vastly undervalued, stating he sees the stock reaching $1250 within 3 years should Apple undertake his proposed plan, basing his price target on an instant 33% jump in earnings that would result from the buyback and more a more normal EBIT multiple of 11x. Shares of AAPL are up just under 1% on the day.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article.