Twitter (TWTR) Soars On First Day of Trading, Leaves at Least $1 Billion on The Table

Twitter’s (TWTR) Market Cap At $24 Billion Following First Day Publicly Traded

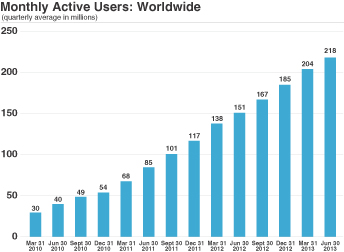

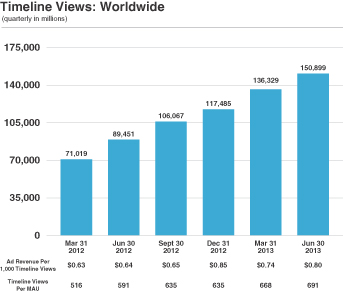

After pricing their IPO at $26, shares of Twitter (TWTR) opened at $45.10 and briefly topped $50 before closing the day at $44.90, giving the company a $24 billion market cap. While most have praised Twitter and the handling of their IPO, I believe management really dropped the ball here. As has been widely reported Twitter loses money and has been investing in growth heavily, so they need as much cash as possible. They failed to raise anywhere near the amount of money they should have by significantly under-pricing their IPO at $26, seemingly giving more consideration to Facebook’s (FB) IPO debacle than to their own balance sheet. Had they priced their offering at even $40 per share, 12% less than what the market ended up valuing them at, Twitter would have added an extra $1 billion to the company’s coffers to fuel future growth. Twitter as a product is great, their social video network Vine is also loved by many with over 40 million users less than a year since launching. TWTR has a great deal of potential to monetize these platforms down the road, but management must be much more prudent in handling their finances moving forward or investors will suffer.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article.